What is the CIL (Community Infrastructure Levy)?

Improvements to local infrastructure are now funded by this contribution applicable to new developments – find out if it’s likely to be applicable to your project with our quick guide.

The Community Infrastructure Levy is a levy which some local authorities in England and Wales charge on developments to fund infrastructure projects within the local authorities such as schools, transport improvements and GP Practices.

It is a development contribution and applies to most new development, including individual building projects. As of 2016, it is a legally enforceable levy which is shown as a land charge on the local land charges register.

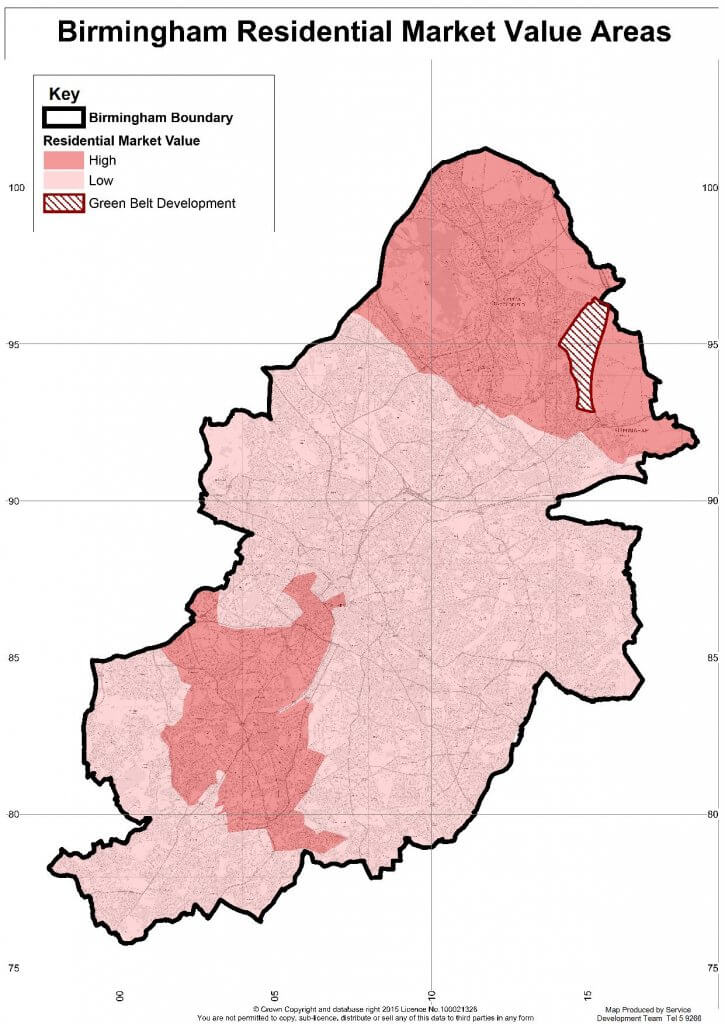

In Birmingham the CIL is applied to fund the development outlined in the Birmingham Development Plan, involving 50,000 new homes and 100,000 new jobs over a twenty-year period. Whether you pay the Community Infrastructure Levy on your development depends on whether the area is considered high value or low value, as shown in the map.

Community Infrastructure Levy FAQs

How much is the Community Infrastructure Levy?

Birmingham City Council set the fee at £69 per square metre in 2016. Other parts of the West Midlands have lower rates.

When does the CIL apply?

Development will potentially be liable for CIL if it:

- Is for a building into which people normally go; and

- Involves new build of at least 100m² gross internal area (GIA) floorspace; or

- Involves a new build of less than 100m² GIA floorspace and the creation of one or more dwellings.

What is exempt from CIL charges?

In terms of residential development, there are few relevant scenarios where CIL may not apply:

- If the project only involves a change of use, conversion or subdivision of, or creation of mezzanine floors within a building which has been in lawful use for at least six months in the three years prior to the development being permitted and does not create any new build floorspace; and

- Self build houses, if occupied by the self-builder for three years;

- Self build residential annex or extensions if main residence and over 100 m²;

- Is for a use or area which benefits from zero or nil charge set out in the CIL Charging schedule.

Even if you think you might be exempt from paying CIL, the form still needs to be completed – failing to do so means you pay the CIL as if it was not exempt.

We’ve also provided answers for some more specific questions that crop up frequently on our building projects:

Will a residential annexe in my garden be liable for CIL?

Not if the property is at your main residence, however please note that your residential annexe will become liable if within three years the annex is used for any purpose other than as an annexe, if it is let out, or either the main residence or annexe are sold separately from the other.

Is an office to residential change of use liable for CIL?

Yes. Permitted development is subject to the Community Infrastructure Levy like any other development. Changes of use to residential are also not exempt from the CIL but an offset is currently allowed for existing floorspace that has been occupied in lawful use for at least 6 of the last 36 months. Some local authorities also have a zero rate for residential. If in doubt ask especially if your office block has been empty for a while.

If I split a detached house into two semi-detached dwellings do I pay CIL?

Residential sub-divisions are not liable for CIL, however if a change of use or additional floor space (over 100 m² or more) are proposed then CIL would apply. It must however have been in a lawful use for six months out of the last three years.

I want to convert my barn into a house, will I have to pay CIL as I am creating a dwelling?

A change of use for the barn to residential would not be liable for CIL as long as the barn is in lawful use (under the six months out of 36 rule) and therefore you would not be liable for CIL.

Is CIL liable on a listed building or within the curtilage of one?

Unless it qualifies for an exemption, CIL applies to listed buildings too.

Who is liable to pay CIL?

The responsibility to pay the levy rests with the owner of the land the liable development will be located on. Although liability rests with the landowner, the regulations recognise that others involved in a development may wish to pay the CIL. To allow this, anyone can come forward and assume liability for the development.

Don't get caught out by the Community Infrastructure Levy!

Speak to our professionals to find out whether your project is liable for the Community Infrastructure Levy by calling us on 0121 455 0032 today!